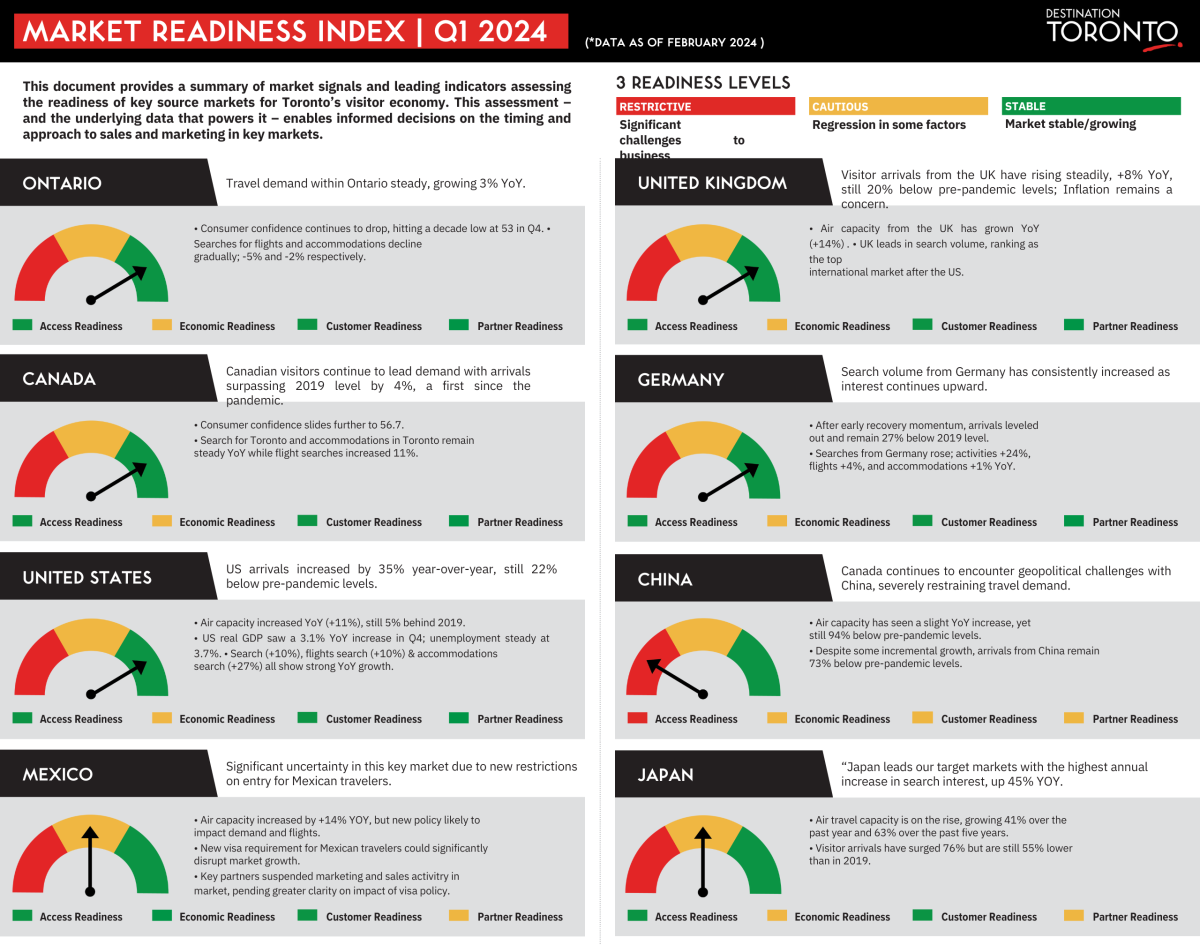

Market Readiness Index

Destination Toronto’s Market Readiness Index is a quarterly summary of market signals and indicators using the latest available data, assessing the readiness of visitor source markets for Toronto’s visitor economy. The index enables informed decisions about the timing and approach of sales and marketing activity to attract visitors to the destination.

To download the report, please use this link.

To download the report, please use this link.