After almost two years of pandemic-related travel restrictions, 2022 saw unprecedented summer travel demand in Toronto. The pandemic also brought a renewed appreciation for the visitor economy as it highlighted the economic contributions of a vibrant tourism industry to related industries and sectors.

In the Fall of 2022, Destination Toronto restarted its semi-annual Toronto Resident Sentiment Survey. The survey will be conducted semi-annually in May and November, with the first wave of the survey data already collected in Fall 2022. The online panel survey, delivered to a random selection of 800 participants residing within the city of Toronto, comprises seven multi-part questions.

Our latest survey explores Toronto residents' perceptions of the city’s visitor economy from two lenses:

- The perceived impact of the industry among residents; and,

- The support from residents for promoting tourism in the city.

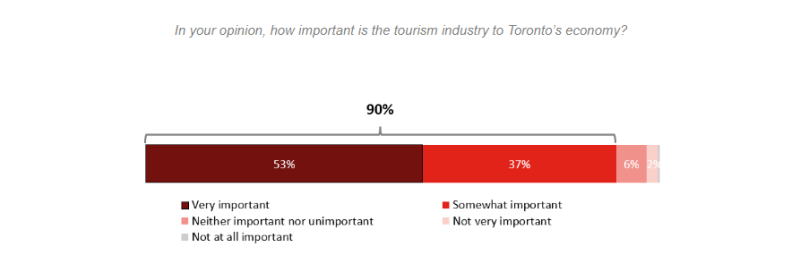

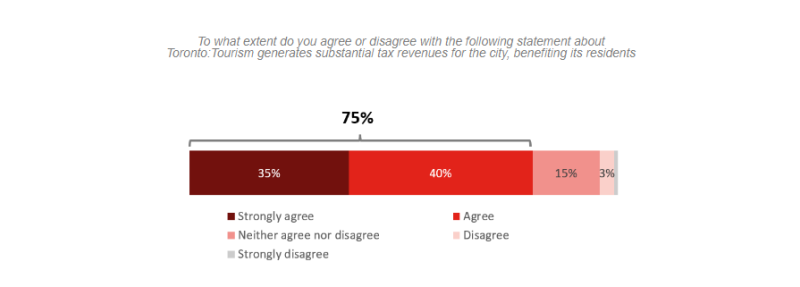

Through the Fall survey, Toronto residents demonstrated a strong support and understanding of the role of tourism and meetings in Toronto’s economy and its impact on their daily lives. Residents acknowledged the importance of the visitor economy, with 90% of the surveyed respondents recognizing its impact on Toronto’s overall economy (Figure. 1), remaining consistent with 2018 survey results. 75% of respondents also acknowledged that tourism generates substantial tax revenues for the city (Figure. 2).

Figure. 1

Figure. 2

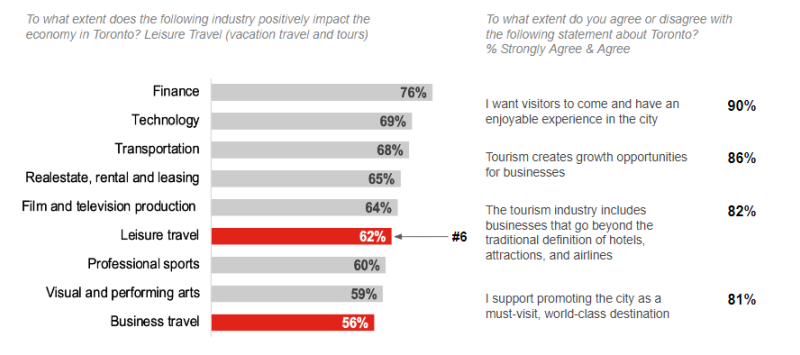

When asked about the positive impact of the industry - both leisure and business travel - 62% of residents acknowledged that leisure travel positively impacts Toronto’s economy, with 86% agreeing that tourism creates growth opportunities for businesses (Figure. 3) and 82% acknowledging the broader definition of the tourism industry which goes beyond hotels, attractions, and airlines.

Figure. 3

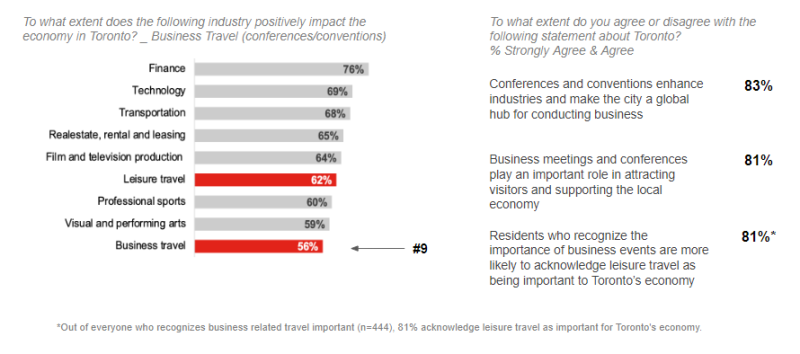

56% of the respondents recognize that business travel has a positive impact on Toronto’s economy. Although when asked specifically about business meetings, conferences and conventions, more than 80% recognize that business events make the city a global hub for conducting business (Figure. 4), and play an important role in attracting visitors and supporting the local economy.

Figure. 4

Safety concerns moved up 3% points compared to 2018, somewhat expected after a global pandemic, but remain a relatively low concern for residents with only 24% agreeing that too many visitors compromise general safety in Toronto’s neighbourhoods. Only 18% of the respondents expressed that visitors get in the way of residents enjoying their community, a significant drop from 30% in 2018.

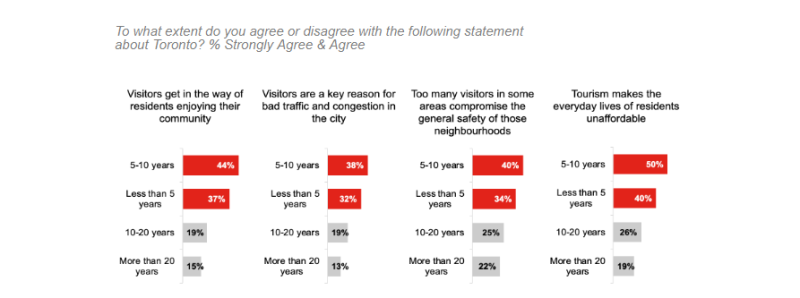

The survey also showed that recent residents, defined here as anyone living in Toronto for less than ten years, are more likely to explore the city. These residents also constitute a majority share of negative perceptions of visitors (Figure. 5). As recent residents are more likely to engage in Tourism related activities, they are also more exposed to visitation related obstacles like wait-times in queues, and busy venues and attractions.

Figure. 5

Note: Figure. 5 shows % of recent residents out of all respondents who had a negative perception of visitors for the respective questions.

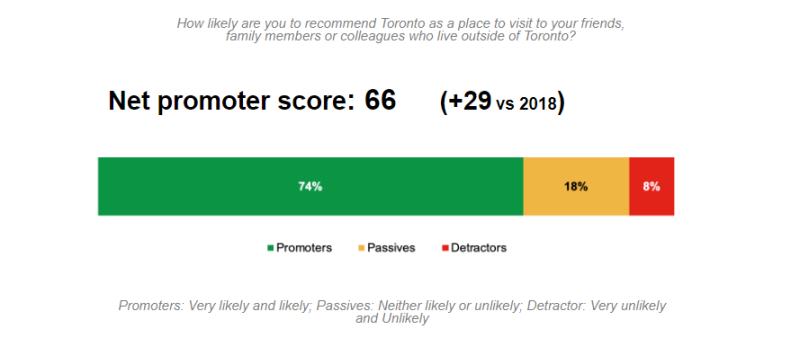

Toronto residents showed a low intent when asked about their propensity for sharing their tourism experiences in Toronto on social media. This remained consistent across various gender and age demographics. Nearly 60% expressed they rarely, if ever, share any of their tourism related experiences in Toronto on social media. However, when asked if they would recommend Toronto as a place to visit to their friends, family or colleagues, 74% identified as promoters on the NPS scale while 6% were identified as detractors (Figure. 6). The resulting NPS of 66 is a significant improvement (+29) from 2018 when it was at 37.

Figure. 6

Overall, Toronto residents’ perceptions and sentiments related to the visitor economy are at their highest since 2018. As the visitor economy continues to recover to the 2019 baseline, it will be critical to continue to measure the evolution of resident perceptions towards the industry and the visitors.

The data in this article was sourced from the survey data analysis performed by Anna Yu, BI Analyst at Destination Toronto.